Thanksgiving is More Than Just a Day

Thanksgiving is my favorite holiday for several reasons:

What Should You Do Now to Protect Your Identity?

This month, we were told that 143 million Americans had key identifying information stolen through the credit reporting company Equifax. In addition, we just learned that Equifax purchased an identification protection service called ID Watchdog on August 10, two weeks after Equifax discovered the data breach but a month before disclosing it publicly. Law enforcement officials from about 40 states are in the process of investigating Equifax’s behavior before and after the data

Evernote: The Best Tool to Get Organized

Evernote is a cloud-based, information organization app. I have been using Evernote since 2011 to capture ideas, notes, important documents, images, and track projects and my goals. Initially I used the free basic version, but then I upgraded to the premium level ($69.99 per year now) and I find it is well worth it as I can do so much more by adding Word documents, PDF documents, and Excel files as well. I would like to share with you a few of the ways I use it to increase my

Alternative Fixed Income Strategies in a Rising Interest Rate Environment

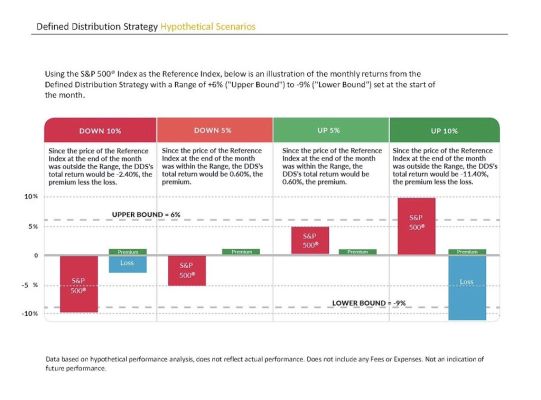

After a long wait, the Fed finally did raise the federal funds rate by 0.25% last month. You may not have noticed the impact in your financial statements yet, but investing in fixed income is becoming more challenging, because traditional bonds with fixed coupons or longer maturities typically recede in price as interest rates rise. Bonds have performed well in the past decade but even they may struggle to deliver the total return you expect over the next few years. So what

Hedged Equity Strategy - Targeting A Smoother Ride for Equity Investors

As the US stock markets have done well for the past 8 years, many investors wonder if their portfolios are positioned well for potential market corrections. Though it is impossible to predict the future, expecting volatility in the coming years is a safe bet. Market volatility is normal, and feeling uneasy about a lower portfolio value is normal too. Historical analysis shows that pullbacks of 5% have occurred about once a quarter, and pullbacks of 10% are likely to occur once