Alternative Fixed Income Strategies in a Rising Interest Rate Environment

After a long wait, the Fed finally did raise the federal funds rate by 0.25% last month. You may not have noticed the impact in your financial statements yet, but investing in fixed income is becoming more challenging, because traditional bonds with fixed coupons or longer maturities typically recede in price as interest rates rise. Bonds have performed well in the past decade but even they may struggle to deliver the total return you expect over the next few years. So what can you do to reduce the interest risk in your portfolio?

Anticipating an upward change in the interest rate, I have researched multiple alternative fixed income strategies this past year, seeking to reduce the allocation accorded to traditional fixed income in the client portfolios I manage. One of them is called Defined Distribution Strategy (DDS), and while it’s quite different from buying bonds, it still seeks to deliver the yield investors are looking for. It provides low price sensitivity to changes in interest rates and limited credit risks compared to traditional bonds.

The goal of DDS, beyond long-term capital preservation, is to generate consistent monthly distributions of 6.5% annualized over the one-month Treasury yield (before fees and expenses). By design, DDS seeks to be non-correlated to the equity and bond markets, and offers an income stream that can be a replacement for investments in bonds.

The DDS begins every month by setting upper and lower bounds (“Target Range”) on the performance of the S&P 500 Index (“Reference Index”) over the calendar month. If the price of the Reference Index is within Target Range at the end of the month, the DDS seeks to not suffer from a principal loss. If the Reference Index completes the month outside the Target Range, then DDS may decline in value. The strategy is implemented by selling and purchasing monthly options on the Reference Index.

To compensate for the risk of loss, the DDS collects a predetermined level of net premium income from the sales and purchase of options. The DDS seeks to optimize the Target Range to collect premium income to meet its monthly distribution target while minimizing the chance of loss.

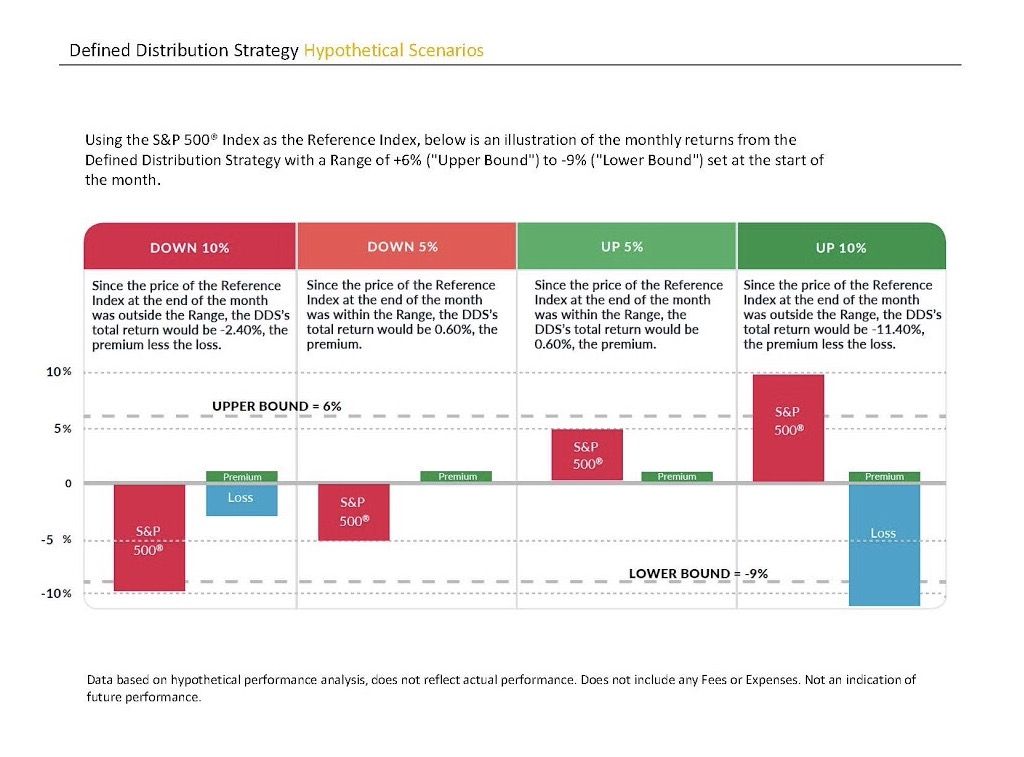

Let’s look at four hypothetical scenarios illustrated in this slide if the upper bound is +6% and lower bound is -9% set at the start of the month:

- S&P 500 Index is down 10%. Since the price of the S&P 500 Index at the end of the month was outside the range, this strategy’s total return would be -2.4%, the premium received from selling options minus the loss.

- S&P 500 Index is down 5%. Since the price of the S&P 500 Index at the end of the month was within the range, this strategy’s total return would be 0.60%, the premium received from selling options.

- S&P 500 Index is up 5%. Since the price of the S&P 500 Index at the end of the month was within the range, this strategy’s total return would be 0.60%, the premium received from selling options.

- S&P 500 Index is up 10%. Since the price of the S&P 500 Index at the end of the month was outside the range, this strategy’s total return would be -11.40%, the premium minus the loss.

The DDS requires determining the Target Range and executing the options monthly. Using the historical simulated performance tool, analyzing current prices of options, and forecasting future prices of the index can improve risk-adjusted return.

You may ask, what happens to the periods that stock markets decline sharply due to certain events? Using the historical theoretically simulated performance tool on the Tech Bubble of March 2001, if the Target Range for that month was +8.54% and -7.08%, S&P 500 Index was down 7.68% in March, this strategy would have negative 1.21% return, much better than investing directly in the index.

Cash isn’t always king. Currently more than $12 trillion of cash - roughly two-thirds the size of U.S. GDP - still sits on the “sidelines”, earning next to nothing and largely missing out on a truly historic bull market. Investors often think of cash as a safe haven during volatile times, or even as a source of income. But the ongoing era of ultra-low interest rates has depressed the yields on most cash instruments to near zero-well below the rate of inflation. With rates expected to rise slowly as the Federal Reserve gradually normalizes monetary policy, investors would be wise to plan that an allocation to cash does not undermine their long-term investment objectives.

Diversification is a risk management technique that mixes a wide variety of investments within a portfolio. Diversification strives to smooth out unsystematic risk events in a portfolio so the positive performance of some investments neutralizes the negative performance of others. The benefits of diversification hold only if the securities in the portfolio are not perfectly correlated. Therefore, using some alternative fixed income investments can earn income while reducing correlations among assets in your portfolio. Alternative fixed income strategies like DDS are relevant today as you review your portfolios periodically to be prepared for market volatility while staying invested.